For some reason, my Canada Revenue Agency direct deposit authorization ended this year. I’ve renewed it, but not before I received a couple of physical Climate Action Incentive Payment cheques, otherwise known as the carbon tax rebate. If you live in a province covered by the federal carbon charge, and you filed your income taxes last year, you or someone in your household got one too!

As a family of four in Alberta, we will be receiving $1544 over the 2023-2024 carbon charge year (the charge increases in April). Our 2023 total was a little below that, since the January 2023 payment was smaller.

The cheque, and the reaction to my posting a picture of it on Xwitter, got me thinking: do I actually get an annual payment large enough to offset what I pay in carbon charges? I don’t think I’d ever really bothered to do the math.

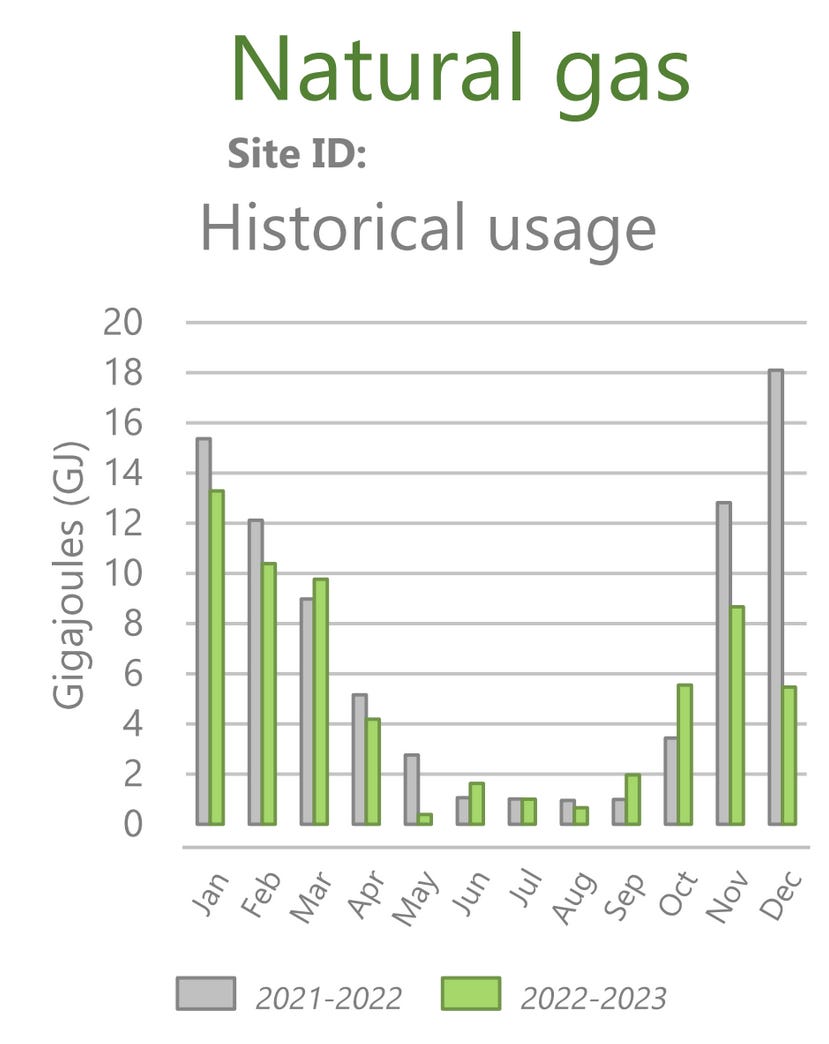

So, the first thing I checked was my natural gas billing. We use gas for our heat and hot water. My supplier, Alberta Coperative Energy (ACE), makes this pretty easy as they allow at data file dump for all of our meter readings, and I can even access daily natural gas and electricity readings. It’s great. So, I have final settlements for January 1, 2023 through December 17th, 2023, and then daily preliminary settlements data through the end of the year. With all of that combined, I used 68.84 GJ of gas (I posted this earlier on Xwitter, but I’d used a different tabulation based on billing data for the year ended December 17, 2023, but this is a bit more accurate) and I paid $199.69 in carbon taxes on those bills.

Here’s the nice little graphic that ACE provides on our bills which shows the numbers I’ve used, except that the balance of December from the daily meter reads was 5.86 extra GJ. Add those to the rightmost green bar. It was a warm December.

I then looked at our household gasoline consumption. This one is harder since we don’t track receipts, but I figured we’d driven roughly 16,000km at 9l/100km when I did my initial calculations for Xwitter purposes. I did a little more digging, and that number is surely an overestimate. Based on odometer readings at vehicle servicing, we’ve likely driven fewer than 12,000km for the 2023 calendar year. At my initial, higher estimate we’d have spent roughly $175 on carbon taxes on fuel, but with my updated numbers, we’d be down closer to $130 assuming our driving is evenly split through the year.

We were also net electricity generators (the last few years have been good for that) in 2023, so we’re not paying any net carbon charges from that, so let’s call that a zero.

So, combined, we’re paying at most about $375, which with GST added would be $393.75, just over the amount on my quarterly rebate cheque. Not bad so far, since there are three more of those cheques.

Now, much of the clamouring on Xwitter felt that this alone was unsatisfactory, and they were right. I haven’t talked about indirect effects of carbon pricing embedded in everything we buy. This one is hard to track individually, but we can use the analysis from this paper by Jen Winter, Brett Dolter, and Kent Fellows as wonderfully translated to an online tool to give us some idea of where those numbers might land.

Here’s where it gets tricky: based on our household income, were pretty low emitters, but that may or may not translate to other parts of our consumption. The online tool, using our houehold income as a proxy for consumption and scaling up to the carbon price levels in 2023, estimates the indirect effects of carbon pricing on our expenses at $769.30 per year. That’s higher than our direct expenses - something which will not likely be true in the broader population - since we’ve pushed our direct expenses down quite substantially through energy efficiency and choosing where we live and how we commute to minimize emissions.

Using that number as a proxy for our indirect costs of carbon pricing, combined with our direct effects above, that would put us at a 2023 carbon pricing expense of $1163.05, almost $300 less than our rebate cheques. And, even without our solar panels, if I included electricity for an average household in our incoome decile from Winter, Dolter, and Fellows, we’d still have credit cash to spare.

This won’t be true for everyone, but it’s much more likely to be true for people in lower income brackets. People often fail to consider just how skewed the distribution of carbon pricing costs is. This graphic from the Winter, Dolter, and Fellows paper shows just how much more high-income-earners pay. The average carbon tax bill is as such much higher than the median carbon tax bill. For example, for Alberta, Winter, Dolter and Fellows found that the average $50 per tonne carbon tax bill would be $1032 per year in Alberta, but the median bill would be much lower at $882. This is why a rebate that returns the average carbon taxes paid to all households can make more than half the households in the country better off.

Don’t forget, though, that this isn’t true for everyone in a given income group. The distribution of net carbon tax costs within income groups is very wide, in particular in Alberta and Saskatchewan (see Figure below, also from Winter, Dolter, and Fellows). This means that no, it is not true that all lower income individuals see a net benefit and nor, as my case would appear to show, is it the case that all higher-income households see a net cost.

You should not consider me to be representative of anything, nor to be claiming to be. I am one data point among millions. That my own emissions would seem likely to be low enough to mean that I get back more in the rebate than I pay in carbon charges tells you nothing about anyone else. Unless they too have a lower-than-average emissions footprint, in which case they too will see a credit that exceeds their costs of carbon pricing.

I guess it also tells you that I might have a few extra dollars to spend at the bike shop.

Thanks for a great post, and for doing some calculations. I wonder how different the debate might have been if the government had invested more time to talking about the tax and the rebate before it got branded by the opposition.

Do you think that a properly explained program might have had a chance? I think so.

Enjoyed your article and I’ve shared it around on Nextdoor and Facebook